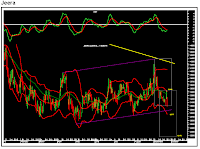

Ncdex RM seed in a correction mode

The adjacent chart shows the price movement of NCDEX RM seed 2-month contract. It was moving up for last several sessions. However it faced resistance near the upper channel line. From there it has entered a correction mode. The daily momentum indicator that had been stretched to the overbought zone has triggered bearish crossover. On the downside junction of 20-day moving average and the lower channel line ie Rs.3,950 and Rs3,935 will be the key area to watch out for. On the other hand, Rs4,093 and Rs4,110 will act as a key resistance zone