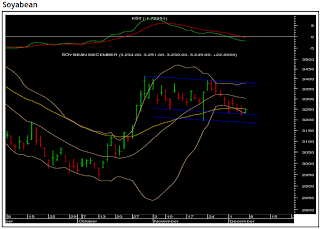

NCDEX RM seed faced resistance near the upper channel line.

The adjacent chart shows the price movement of NCDEX RM seed 2-month contract. It has been moving up for the last few sessions. However it recently faced resistance near the upper channel line. From there it entered a correction mode. The daily momentum indicator has reached the overbought zone and needs to cool off. From a short-term perspective the agri commodity can come down till Rs.3,965 and Rs.3,915. On the other hand, the recent high of Rs.4,154 will act as a key resistance.