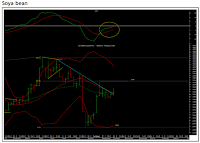

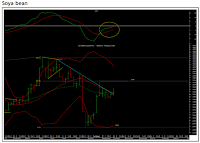

The adjoining chart is a weekly chart of NCDEX soya bean. We can observe that soya bean broke the trading range on the upside and it rallied smartly towards the crucial resistances. For the past five weeks, it has been oscillating around the crucial resistances. Last week we saw the agricommodity gave a positive weekly close and also closed above the resistance line (shown in blue colour). On a shorter time frame, we can observe that the agricommodity is consolidating in a range and has taken shape of a triangle, which has been broken on the upside. It faced resistance at the daily upper Bollinger Band and corrected once again. This indicates indecision among the market participants. The weekly momentum indicator has a positive crossover and reached the equilibrium line, which completes the pullback cycle. Our view on the agricommodity remains bearish and we expect soya bean to trade weak going ahead. Our targets on the downside are placed at Rs2,866, which is the weekly lower Bollinger Band. the stop loss should be trailed to Rs3,698, which is the 61.8% retracement level of the fall from Rs4,276 to Rs2,838.