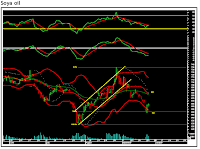

Soya oil all set to boil

The adjoining chart is of NCDEX soya oil October contract. We can observe that soya oil has been correcting sharply for the past few weeks. In the penultimate trading session it formed an engulfing bull candlestick pattern which has bullish implications. In our previous report on soya oil we had forecast that soya oil would correct up to Rs650 which was the 78.6% retracement of the fall. It achieved the target. Going ahead we expect soya oil to trade positive for the target of Rs682, which is the area of 20- and 40-daily moving averages. The reversal of the bullish stance is placed below Rs648, which is the low of the engulfing bull candlestick pattern. And below this level the pattern will get negated.