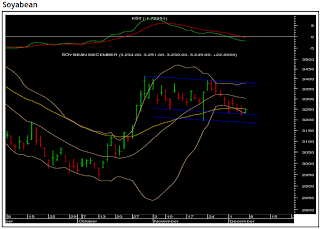

Ncdex Soyabean is moving up in a channelised manner 25 April 2016

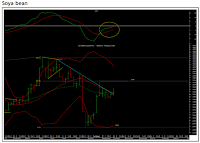

For several weeks NCDEX soybean was oscillating about the key DMAs. In terms of price patterns, the agri-commodity formed a triangular pattern, which broke out on the upside. Since the breakout the commodity has been marching towards north. It consolidated near the previous high of Rs4,121 and 78.6% retracement mark for few days and started moving higher. The commodity is moving up in a channelised manner. The subsequent levels on the upside will be Rs 4,412 and Rs 4,560. The level of Rs 4,121 will act as a crucial support on a closing basis