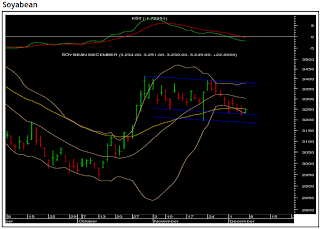

Soya oil: Scaling higher

The adjacent chart shows the price movement of NCDEX soya oil January contract. The agri-commodity is moving up in a medium-term rising channel. Within that channel it had formed a short-term falling channel. Recently it has broken-out from the falling channel. The daily momentum indicator is in line with the bullish breakout. The key level on the upside will be Rs.632, ie the upper end of the rising channel. The swing’s high of Rs.615.20 will act as an intermediate resistance. On the other hand, Rs.603 and Rs.596 will act as the key support zone.